Supply & Demand

A market in transition

In 2024, geopolitical uncertainty and heightened concerns about energy security, national security, and climate change continued to improve the demand and supply fundamentals for the nuclear power industry and the fuel cycle that is required to support it.

Increasingly, countries and companies around the globe are recognizing the critical role nuclear power must play in providing carbon-free and secure baseload power. This was evidenced at the 29th Conference of Parties (COP29), where a total of 31 countries have now signed the declaration to triple nuclear energy capacity by 2050.

This growing support has led to a rise in demand with closed reactors returning to service, reactor life extensions being sought and approved, and numerous commitments and plans are advancing for the construction of new nuclear capacity. In addition, there is increasing interest in small modular reactors (SMR), including smaller versions of existing technology and advanced technology designs, with companies in energy intensive sectors looking to nuclear to help achieve their decarbonization plans. The potential expansion of the markets and use cases for nuclear energy could add significant demand in the decades to come.

While demand continues to increase, future supply is not keeping pace. Heightened supply risk caused by growing geopolitical uncertainty, shrinking secondary supplies and a lack of investment in new capacity over the past decade has motivated utilities to evaluate their near-, mid- and long-term nuclear fuel supply chains. The uncertainty about where nuclear fuel supplies will come from to satisfy growing demand has led to significant long-term contracting activity in recent years.

In 2024, about 119 million pounds of uranium was placed under long-term contracts by utilities. While the volume remains below replacement rate, this further increases the cumulative level of uncovered requirements in the decade to come, when primary supply is expected to be even more limited and uncertain, and secondary supply stacks have been drawn down.

We expect continued competition to secure uranium, conversion services and enrichment services under long-term contracts with proven sustainable producers and suppliers who have a diversified portfolio of assets in geopolitically attractive jurisdictions, and on terms that help ensure a reliable supply is available to satisfy demand.

Supply uncertainty

Geopolitical uncertainty, energy security, and national security are notable factors impacting security of supply in 2024.

Geopolitical uncertainty is causing some utilities to seek nuclear fuel suppliers whose values are aligned with their own or whose origin of supply better protects them from potential interruptions, including from transportation challenges or the possible imposition of formal sanctions. Driven by the Russian invasion of Ukraine, the mine suspension in Niger, and supply chain challenges, particularly in Kazakhstan, many governments and utilities are re-examining procurement strategies that rely on nuclear fuel supplies from these jurisdictions.

With the lack of investment over the past decade, there is growing uncertainty about where uranium will come from to satisfy growing demand, and utilities are becoming increasingly concerned about the availability of material to meet their long-term needs. Several uranium projects restarted in 2024 in support of increased demand, though delays and higher-than-expected production costs were a common theme.

In addition, secondary supplies have diminished, and the material available in the spot market has thinned as producers and financial funds continue to purchase material.

Despite the positive price trend in 2024, the deepening geopolitical uncertainty, sanctions and trade policy restrictions, and years of underinvestment in new uranium and fuel cycle service capacities, supply risk has shifted from producers to utilities.

Durable demand growth

The benefits of nuclear energy have come clearly into focus, supporting a level of durability that, we believe, has not been previously seen. The durability is being driven not only by the geopolitical realignment in energy markets but also by a global focus on achieving the net-zero carbon targets set by countries and companies around the world.

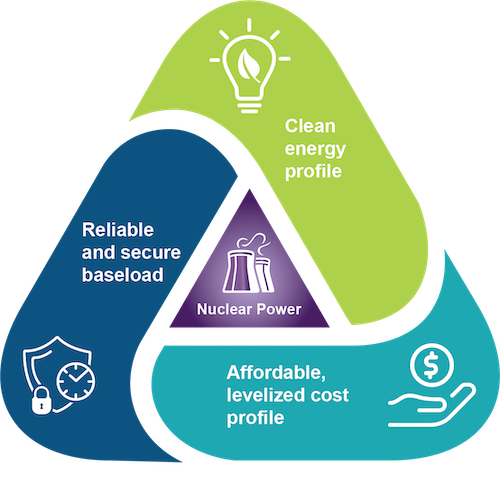

Geopolitical uncertainty has deepened concerns about energy security and national security, highlighting the role of energy policy in balancing three main objectives:

- providing a reliable and secure baseload profile;

- providing an affordable, levelized cost profile;

- providing a clean emissions profile.

Net-zero carbon targets are also turning global attention to a broader triple challenge:

- about one-third of the global population must be lifted out of energy poverty by improving access to clean and reliable baseload electricity;

- approximately 80% of the current global electricity grids that run on carbon-emitting sources of thermal power must be replaced with a carbon-free, reliable alternative;

- and global power grids must grow by electrifying industries, such as private and commercial transportation, and home and industrial heating, which today are largely powered with carbon-emitting sources of thermal energy.

There is increasing recognition that nuclear power meets these objectives and has a key role to play in achieving energy security and decarbonization goals. The growth in demand is not just long-term and in the form of new builds, but medium-term in the form of reactor restarts and life extensions, and near-term with early reactor retirement plans being deferred or cancelled and new markets continuing to emerge. Long-term momentum remains very supportive with the installed base of nuclear capacity and an increasing focus on large-scale new build and the development of SMRs.

The IEA World Energy Outlook 2024 predicts a 62% increase in electricity demand from 2023 to 2040, with a 95% increase predicted from 2023 to 2050.

| Future estimates | Historic | |

| 1990 | 10092 | |

| 2010 | 21511 | |

| 2022 | 29145 | |

| 2023 | 29863 | |

| 2030 | 37489 | |

| 2040 | 48409 | |

| 2050 | 58352 |

According to the International Atomic Energy Agency (IAEA), globally, there are currently 439 operable reactors and 63 reactors under construction. Demand-related developments continue to suggest growing support for the nuclear industry, with 31 countries pledging to triple their nuclear power capacity by 2050.

| Number of Reactors | |

| China | 29 |

| Asia | 10 |

| India | 6 |

| Africa & Middle East | 6 |

| Russia | 5 |

| Eastern Europe | 3 |

| Americas | 2 |

| UK | 2 |

Supply-Demand: Putting it Together

Like other commodities, the demand for uranium is cyclical. However, unlike other commodities, uranium is not traded in meaningful quantities on a commodity exchange. The uranium market is principally based on bilaterally negotiated long-term contracts covering the annual run-rate requirements of nuclear power plants, with a small spot market to serve discretionary demand.

History demonstrates that in general, when prices are rising and high, uranium is perceived as scarce, and more contracting activity takes place with proven and reliable suppliers. The higher demand discovered during this contracting cycle drives investment in higher-cost sources of production, which due to lengthy development timelines, tend to miss the contracting cycle and ramp up after demand has already been won by proven producers.

When prices are declining and low, there is no perceived urgency to contract, and contracting activity and investment in new supply dramatically decreases. After years of low prices, and a lack of investment in supply, and as the uncommitted material available in the spot market begins to thin, security-of-supply tends to overtake price concerns. Utilities typically re-enter the long-term contracting market to ensure they have a reliable future supply of uranium to run their reactors.

| Spot Market | Long Term Market | Average Spot Price | |

| 2004 | 20 | 84 | 18.6 |

| 2005 | 36 | 252 | 28.67 |

| 2006 | 35 | 200 | 49.6 |

| 2007 | 20 | 250 | 99.29 |

| 2008 | 43 | 130 | 61.58 |

| 2009 | 54 | 150 | 46.06 |

| 2010 | 50 | 250 | 46.83 |

| 2011 | 56 | 112 | 56.36 |

| 2012 | 43 | 193 | 48.4 |

| 2013 | 50 | 24 | 38.17 |

| 2014 | 43 | 77 | 33.21 |

| 2015 | 49 | 81 | 36.55 |

| 2016 | 46 | 60 | 25.64 |

| 2017 | 48.1 | 73.1 | 21.78 |

| 2018 | 88.5 | 89.9 | 24.59 |

| 2019 | 63.3 | 95.8 | 25.64 |

| 2020 | 94.5 | 57.4 | 29.96 |

| 2021 | 102.41 | 71.79 | 35.28 |

| 2022 | 60.85 | 113.00 | 49.81 |

| 2023 | 55.03 | 159.60 | 62.51 |

| 2024 | 46.37 | 119.2 | 85.14 |

UxC reports that over the last five years approximately 534 million pounds U3O8 equivalent have been locked-up in the long-term market, while approximately 798 million pounds U3O8 equivalent have been consumed in reactors. UxC estimates that cumulative uncovered requirements are about 2.1 billion pounds to the end of 2040. We believe this presents a substantial opportunity for proven and reliable suppliers with tier-one productive capacity and a record of honoring supply commitments.

We will continue to take the actions we believe are necessary to position the company for long-term success, aligning our production decisions with customers’ needs under our contract portfolio. We will undertake contracting activity which is intended to ensure we have adequate protection while maintaining exposure to the benefits that come from having uncommitted, low-cost supply to place into a strengthening market.

Caution about Forward-Looking Information

Please click here for additional information about the assumptions applied in making the forward-looking statements on this page and the factors that could cause results to differ materially.