Exploration

Our exploration program is focused on replacing mineral reserves as they are depleted by our production, which is key to sustaining our business, meeting our commitments, and ensuring long-term growth. Our exploration activity is adjusted annually in line with market signals and at a pace aligned with Cameco’s mining plans and marketing requirements. In recent years, as we began to bring back our tier-one production, we also increased exploration spending, all in response to the positive momentum in the nuclear fuel market, which has provided a clear signal that more uranium production will be required in the next decade, setting the stage for a renewed exploration cycle.

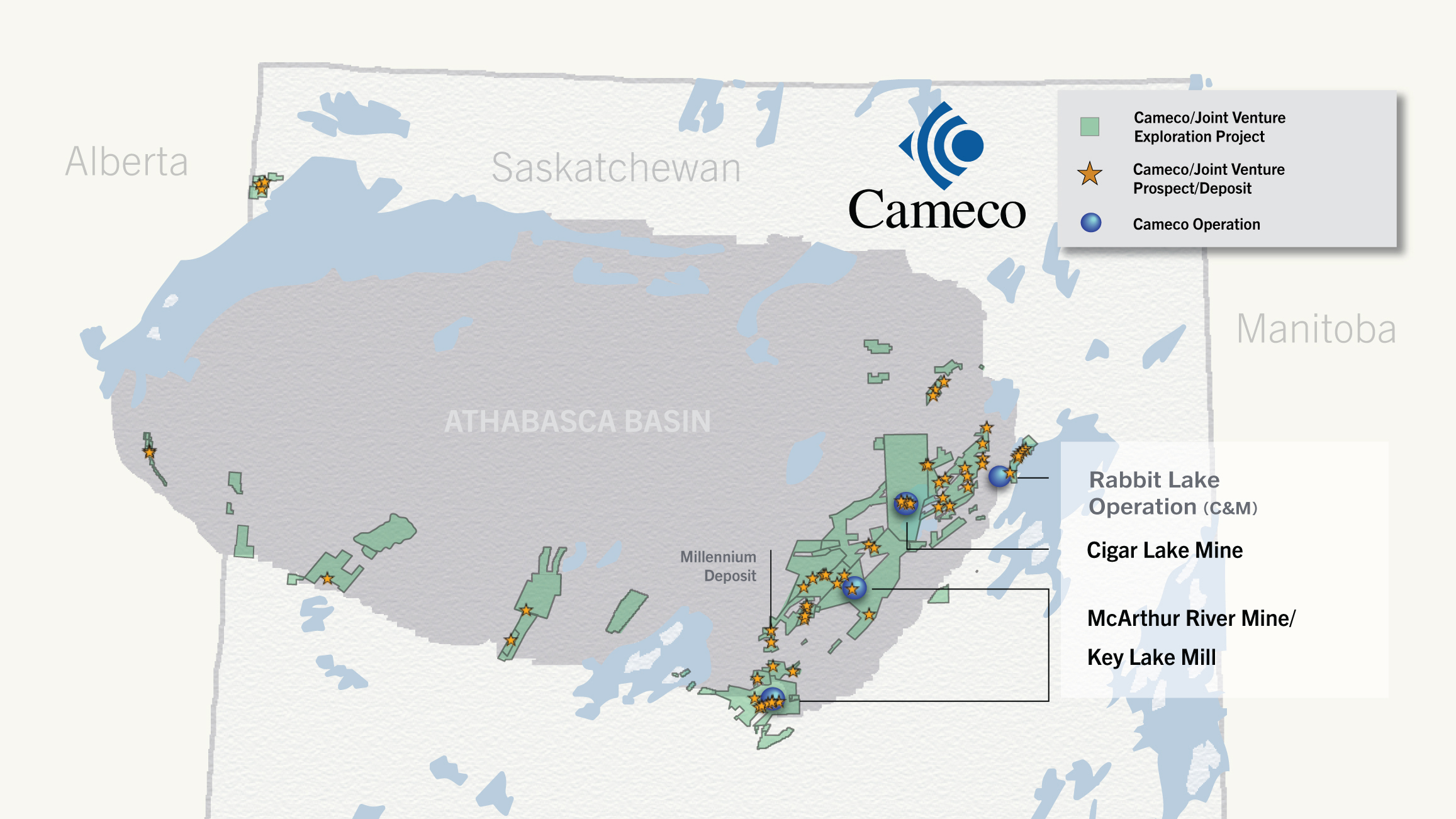

Our position as one of the world’s largest uranium producers and our continued growth across the nuclear fuel cycle has been driven by decades of experience and our history of exploration, discovery and mining successes. Our land position totals 754,000 hectares (1.8 million acres) that cover exploration and development prospects in Canada, Australia, Kazakhstan and the US that are among the best in the world. In northern Saskatchewan alone, we have direct interests in 660,000 hectares (1.6 million acres) that cover many of the most prospective areas of the Athabasca Basin.

Northern Saskatchewan

Our well-established infrastructure includes fully licensed and fully permitted uranium mills and mines in the eastern Athabasca basin, along with a supporting network of roads, airstrips and electricity supply. that not only underpins the potential development of our advanced exploration projects, but also supports:

- our ongoing work to both delineate existing prospects and deposits,

- ongoing work to identify undiscovered uranium potential

- our decades of work to establish a positive corporate reputation by prioritizing our relationships with northern Saskatchewan Indigenous communities, confirms our long-term commitment to continually engage and provide ongoing benefits to the people that call the region home

The well-known uranium endowment of the Athabasca Basin, where we are involved in 45 projects (including partner-operated joint ventures, previously 39 projects in 2023), is the result of its unique geology, creating a remarkable mining jurisdiction that hosts the highest uranium grades and some of the largest uranium deposits in the world. On our projects, numerous uranium occurrences have been identified, along with several prospects and undeveloped deposits of variable grades and sizes which have progressed through multiple stages of evaluation. Depending on the potential deposit size, ore and ground quality, evolving mining technologies and the uranium market environment, some of these prospects are expected to become viable, economic deposits in a uranium market and price environment that supports new primary production and provides an adequate risk-adjusted return.

2024 Update

- Brownfield and advanced exploration

Brownfields and advanced exploration activities include exploration near our existing operations and expenditures for maintaining advanced projects and delineation drilling where uranium mineralization is being defined. In 2024, we spent about $4 million in Saskatchewan, $2 million in Australia and $1 million in the US on brownfield and advanced exploration projects. The spending in Saskatchewan was primarily focused on advanced exploration on the Dawn Lake project.

On the LaRocque Lake corridor of the Dawn Lake project located approximately 45 km northwest of the Rabbit Lake operation, our 2024 exploration drilling continued to expand the footprint of known uranium mineralization with additional high-grade mineralized intercepts. Although the deposit remains at an early stage of exploration, the results to date are comparable to those of other mines and known deposits in the Athabasca Basin.

- Regional exploration

Regional exploration is defined as projects that are considered greenfields. In 2024, we spent over $8 million on regional exploration programs that are comprised of target generation geophysical surveys and diamond drilling primarily in northern Saskatchewan.

Planning for the future

We plan to continue to focus on our core projects in Saskatchewan under our long-term exploration framework. Our leadership position and industry expertise in both exploration and corporate social responsibility makes us a partner of choice. For properties and projects that meet our investment criteria, we may partner with other companies through strategic alliances, equity holdings and traditional joint venture arrangements to optimize our exploration activity and spending.

- Brownfields and Advanced Exploration

In 2025, we plan to spend about $9 million on brownfields and advanced exploration, primarily to refine the footprint of the mineralization identified on the LaRocque Lake corridor of the Dawn Lake project, and to undertake a brownfield exploration program at McArthur River.

- Regional exploration

We plan to spend approximately $12 million on diamond drilling and target generation geophysical surveys on our core regional projects in Saskatchewan, in 2025.

Caution about Forward-Looking Information

Please click here for additional information about the assumptions applied in making the forward-looking statements on this page and the factors that could cause results to differ materially.