Inkai

- Inkai is owned 40% by Cameco and 60% by Kazatomprom, which is majority-owned by the Kazakh government.

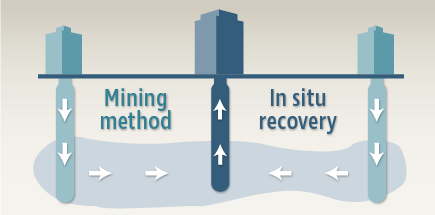

- Tapping into the vast uranium potential of Kazakhstan, Joint Venture Inkai LLP operates the in situ recovery mine.

- The ISO 14001 and BSI OHSAS 18001 certified facility follows western standards for worker safety and environmental protection since it began operations in 2008.

Production

2025 Q3 Update

- Production

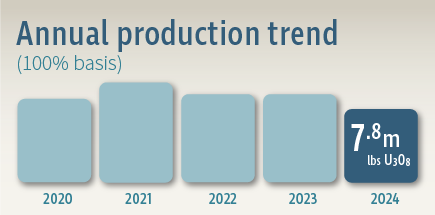

Production on a 100% basis was 2.4 million pounds for the quarter, and 5.9 million pounds for the first nine months of this year, compared to 2.0 million pounds and 5.5 million pounds, respectively in the same period last year. Following the unplanned, temporary production suspension in January 2025, the adjusted mine plan resulted in higher second quarter production bringing production for the first nine months back in line with the annual production plan.

JV Inkai is targeting 2025 production of 8.3 million pounds (100% basis) of which our purchase allocation is expected to be 3.7 million pounds. The temporary suspension in early 2025 did not have a material impact on JV Inkai’s 2025 outlook. The achievement of JV Inkai’s 2025 production target requires it to successfully manage several ongoing risks, including the availability of sulfuric acid, other procurement and supply chain issues, transportation challenges, construction delays and inflationary pressures on its production costs.Due to equity accounting, our share of production is shown as a purchase at a 5% discount to the spot price and included in inventory at this value at the time of delivery. The first shipment from JV Inkai containing our remaining share of 2024 production (approximately 900,000 pounds) and approximately 2.0 million pounds of our share of Inkai’s 2025 production is currently in transit and expected to arrive at the Blind River refinery in early November. The majority of our remaining share of 2025 production from JV Inkai is expected to be delivered before the end of 2025. Our share of the profits earned by JV Inkai on the sale of its production to the joint venture partners is included in “share of earnings from equity-accounted investee” on our consolidated statement of earnings. Excess cash, net of working capital requirements, is distributed to the partners as dividends once declared.

- Delivery Schedule

The geopolitical situation continues to cause transportation risks in the region. We could continue to experience delays in our expected Inkai deliveries. To mitigate this risk, we have inventory, long-term purchase agreements and loan arrangements in place we can utilize. Depending on when we receive shipments of our share of Inkai’s production, our share of earnings from this equity-accounted investee and the timing of the receipt of our share of dividends from the joint venture may be impacted.

Environment & Safety

Worker safety, environmental monitoring and proper decommissioning after project completion are of the utmost importance to Cameco.

Reserves & Resources

Our mineral reserves and resources are the foundation of our company and fundamental to our success.

Caution about Forward-Looking Information

This page may contain forward-looking information that is based upon the assumptions and subject to the material risks discussed on page 2 of Cameco's most recent Quarterly MD&A.