Proven and Probable Reserves

As at December 31, 2024

(100% basis)

Tonnes in thousands; pounds in millions

Proven reserves

| Cigar Lake | Key Lake | McArthur River | Inkai | |

|---|---|---|---|---|

| Canada | 118.4 | 0.7 | 295.8 | |

| Kazakhstan | 201.6 |

| Average Grade (%) | |

|---|---|

| Cigar Lake | 16.68 |

| Key Lake | 0.52 |

| McArthur River | 6.81 |

| Inkai | 0.03 |

| Tonnes | |

|---|---|

| Cigar Lake | 322.0 |

| Key Lake | 61.1 |

| McArthur River | 1970.3 |

| Inkai | 277232.9 |

| Cigar Lake | Key Lake | McArthur River | Inkai | |

|---|---|---|---|---|

| Canada | 74.5 | 0 | 63.7 | |

| Kazakhstan | 49.4 |

| Average Grade (%) | |

|---|---|

| Cigar Lake | 14.73 |

| Key Lake | 0 |

| McArthur River | 5.56 |

| Inkai | 0.02 |

| Tonnes | |

|---|---|

| Cigar Lake | 229.4 |

| Key Lake | 0 |

| McArthur River | 520.4 |

| Inkai | 90850.8 |

| Cigar Lake | Key Lake | McArthur River | Inkai | |

|---|---|---|---|---|

| Canada | 192.9 | 0.7 | 359.6 | |

| Kazakhstan | 251.0 |

| Average Grade (%) | |

|---|---|

| Cigar Lake | 15.87 |

| Key Lake | 0.52 |

| McArthur River | 6.55 |

| Inkai | 0.03 |

| Tonnes | |

|---|---|

| Cigar Lake | 551.4 |

| Key Lake | 61.1 |

| McArthur River | 2490.7 |

| Inkai | 368083.7 |

| Proven reserves | Probable reserves | Total mineral reserves | |||||||||

| Property | Tonnes | Grade | Content | Tonnes | Grade | Content | Tonnes | Grade | Content | Cameco's share | Metallurgical |

| Cigar Lake (UG) | 322.0 | 16.68 | 118.4 | 229.4 | 14.73 | 74.5 | 551.4 | 15.87 | 192.9 | 105.2 | 98.7 |

| Key Lake (OP) | 61.1 | 0.52 | 0.7 | - | - | - | 61.1 | 0.52 | 0.7 | 0.6 | 95 |

| McArthur River (UG) | 1,970.3 | 6.81 | 295.8 | 520.4 | 5.56 | 63.7 | 2,490.7 | 2.55 | 359.6 | 251.0 | 99.2 |

| Inkai (ISR) | 277,232.9 | 0.03 | 201.6 | 90,850.8 | 0.02 | 49.4 | 368,083.7 | 0.03 | 251.0 | 100.4 | 85 |

| Total | 279,586.3 | – | 616.5 | 91,600.6 | – | 187.6 | 371,187.0 | – | 804.1 | 457.2 | - |

Notes

UG = underground | OP = open pit | ISR = in situ recovery

Note that the estimates in the above table:

- use a constant dollar average uranium price of approximately $63 (US) per pound U3O8

- are based on exchange rates of $1.00 US=$1.26 Cdn and $1.00 US=450 Kazakhstan Tenge

- may not add due to rounding

Our estimate of mineral reserves and mineral resources may be positively or negatively affected by the occurrence of one or more of the material risks discussed under the heading Caution about forward-looking information in our 2024 Q4 MD&A, as well as certain property-specific risks. See Uranium - Tier-one operations in our 2024 Q4 MD&A.

Metallurgical recovery

We report mineral reserves as the quantity of contained ore supporting our mining plans and provide an estimate of the metallurgical recovery for each uranium property. The estimate of the amount of valuable product that can be physically recovered by the metallurgical extraction process is obtained by multiplying the quantity of contained metal (content) by the planned metallurgical recovery percentage. The content and our share of uranium in the table above are before accounting for estimated metallurgical recovery.

Mineral Reserves and Resources

Our mineral reserves and resources are the foundation of our company and fundamental to our success.

We have interests in a number of uranium properties. The tables in this section show the estimates of the proven and probable mineral reserves, and measured, indicated, and inferred mineral resources at those properties. However, only three of the properties listed in those tables are material uranium properties for us: McArthur River/Key Lake, Cigar Lake and Inkai. Mineral reserves and resources are all reported as of December 31, 2024.

We estimate and disclose mineral reserves and resources in five categories, using the definition standards adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council, and in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101), developed by the Canadian Securities Administrators.

- About mineral resources

Mineral resources do not have to demonstrate economic viability but have reasonable prospects for eventual economic extraction. They fall into three categories: measured, indicated and inferred. Our reported mineral resources are exclusive of mineral reserves.

- measured and indicated mineral resources can be estimated with sufficient confidence to allow the appropriate application of technical, economic, marketing, legal, environmental, social and governmental factors to support evaluation of the economic viability of the deposit

- measured resources: we can confirm both geological and grade continuity to support detailed mine planning

- indicated resources: we can reasonably assume geological and grade continuity to support mine planning

- inferred mineral resources are estimated using limited geological evidence and sampling information. We do not have enough confidence to evaluate their economic viability in a meaningful way. You should not assume that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource, but it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

Our share of uranium in the following mineral resource tables is based on our respective ownership interests. Reported mineral resources have not demonstrated economic viability.

- About mineral reserves

Mineral reserves are the economically mineable part of measured and/or indicated mineral resources demonstrated by at least a preliminary feasibility study. The reference point at which mineral reserves are defined is the point where the ore is delivered to the processing plant, except for ISR operations where the reference point is where the mineralization occurs under the existing or planned wellfield patterns. Mineral reserves fall into two categories:

- proven reserves: the economically mineable part of a measured resource for which at least a preliminary feasibility study demonstrates that, at the time of reporting, economic extraction could be reasonably justified with a high degree of confidence

- probable reserves: the economically mineable part of a measured and/or indicated resource for which at least a preliminary feasibility study demonstrates that, at the time of reporting, economic extraction could be reasonably justified with a degree of confidence lower than that applying to proven reserves

We use current geological models, an average uranium price of $63 (US) per pound U3O8, and current or projected operating costs and mine plans to report our mineral reserves, allowing for dilution and mining losses. We apply our standard data verification process for every estimate. For properties in which Cameco has an interest but is not the operator, we will take reasonable steps to ensure that the reserve and resource estimates that we report are reliable.

Our share of uranium in the mineral reserves table below is based on our respective ownership interests.

- Changes this year

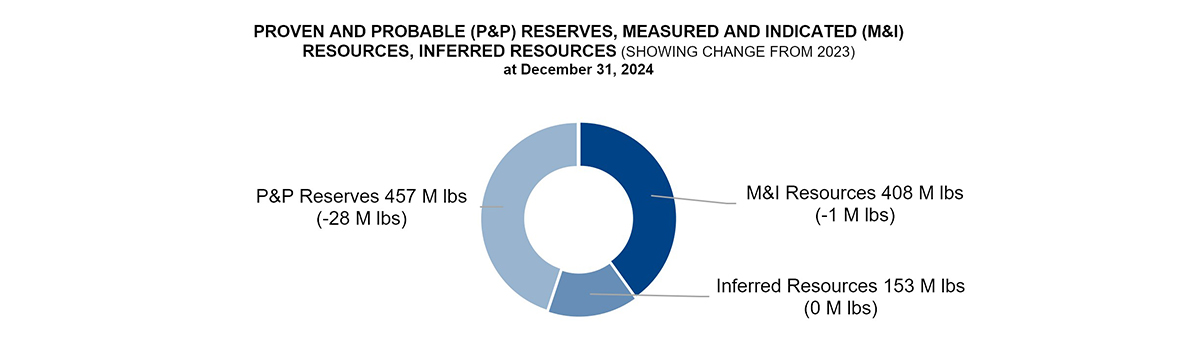

- Image

Our share of proven and probable mineral reserves decreased from 485 million pounds U3O8 at the end of 2023, to 457 million pounds at the end of 2024. The change was primarily the result of:

- production at Cigar Lake, Inkai and McArthur River, which removed 27 million pounds of proven and probable reserves from our mineral inventory.

The remaining changes are attributable to other adjustments based on the mineral reserve estimate updates at Cigar Lake, McArthur River and Inkai.

Our share of measured and indicated mineral resources decreased from 409 million pounds U3O8 at the end of 2023 to 408 million pounds at the end of 2024. Our share of inferred mineral resources remained unchanged at 153 million pounds U3O8.

- Qualified persons

The technical and scientific information discussed on this page for our material properties (McArthur River/Key Lake, Cigar Lake and Inkai) was approved by the following individuals who are qualified persons for the purposes of NI 43-101:

McArthur River/Key Lake

- Greg Murdock, general manager, McArthur River, Cameco

- Daley McIntyre, general manager, Key Lake, Cameco

- Alain D. Renaud, principal resource geologist, technical services, Cameco

- Biman Bharadwaj, principal metallurgist, technical services, Cameco

Cigar Lake

- Kirk Lamont, general manager, /Cigar Lake, Cameco

- Scott Bishop, director, technical services, Cameco

- Alain D. Renaud, principal resource geologist, technical services, Cameco

- Biman Bharadwaj, principal metallurgist, technical services, Cameco

Inkai

- Alain D. Renaud, principal resource geologist, technical services, Cameco

- Scott Bishop, director, technical services, Cameco

- Biman Bharadwaj, principal metallurgist, technical services, Cameco

- Sergey Ivanov, deputy director general, technical services, Cameco Kazakhstan LLP

- Important information about mineral reserve and resource estimates

Although we have carefully prepared and verified the mineral reserve and resource figures in this document, the figures are estimates, based in part on forward-looking information.

Estimates are based on knowledge, mining experience, analysis of drilling results, the quality of available data and management’s best judgment. They are, however, imprecise by nature, may change over time, and include many variables and assumptions, including:

- geological interpretation

- extraction plans

- commodity prices and currency exchange rates

- recovery rates

- operating and capital costs

There is no assurance that the indicated levels of uranium will be produced, and we may have to re-estimate our mineral reserves based on actual production experience. Changes in the price of uranium, production costs or recovery rates could make it unprofitable for us to operate or develop a particular site or sites for a period of time. See page 2 of our 2024 Q4 MD&A for information about forward-looking information.

Please see our mineral reserves and resources section of our most recent annual information form for the specific assumptions, parameters and methods used for McArthur River, Inkai and Cigar Lake mineral reserve and resource estimates.

- Important information for US investors

We present information about mineralization, mineral reserves and resources as required by National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (NI 43-101), in accordance with applicable Canadian securities laws. As a foreign private issuer filing reports with the US Securities and Exchange Commission (SEC) under the Multijurisdictional Disclosure System, we are not required to comply with the SEC’s disclosure requirements relating to mining properties. Investors in the United States should be aware that the disclosure requirements of NI 43-101 are different from those under applicable SEC rules, and the information that we present concerning mineralization, mineral reserves and resources may not be comparable to information made public by companies that comply with the SEC’s reporting and disclosure requirements for mining companies.