Uranium: growing production

We have a strategy and process in place to increase our annual production to 40 million pounds by 2018, which we expect to come from three sources:

- operating properties

- development projects

- projects under evaluation

We expect about half of the total 2018 annual production will come from mines that are already operating, while the other half is expected to come from projects that are in development or under evaluation.

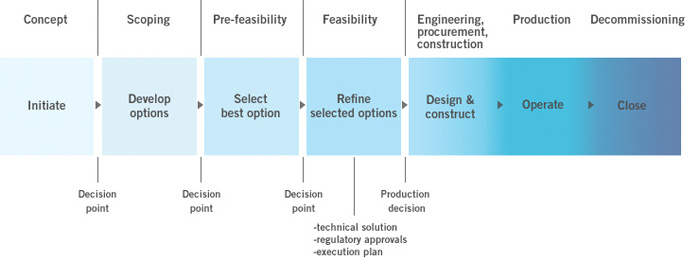

We advance each project through a stage gate process that includes several defined decision points in the assessment and development stages. At each point, we re-evaluate the project based on current economic, competitive, social, legal, political and environmental considerations. If it continues to meet our criteria, we proceed to the next stage. This process allows us to build a pipeline of projects ready for a production decision.

Stage gate process

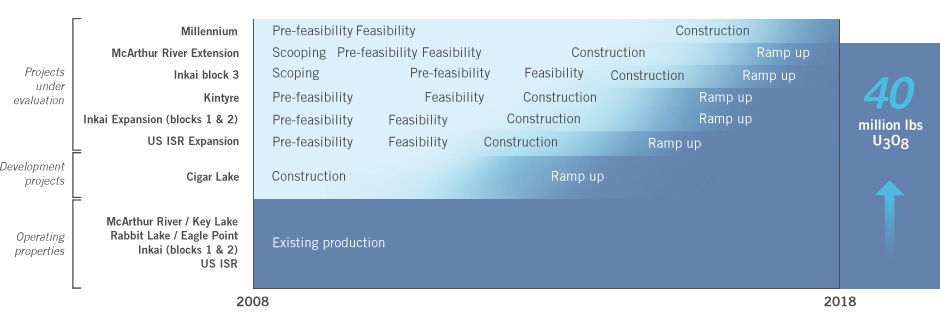

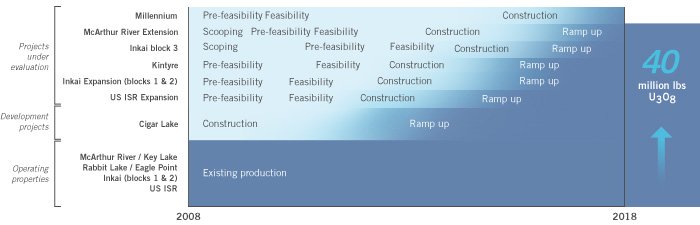

The chart below shows the mix of projects we had when we started our Double U strategy in 2008 and how we expect each of these sources to progress towards achieving our 2018 production goal.

Double U project pipeline

Click to enlarge

Click to enlarge

Many of these projects are in the early stage. Depending on the results of our evaluation activities or changing market signals, the mix of projects to reach our 2018 goal may change.

To meet our goal, we estimate our capital costs for the development projects and projects under evaluation in the chart will be between $200 and $400 million per year in growth capital for the next three years. See Capital spending.

This is a preliminary estimate that we expect to fund using existing cash balances and operating cash flows. Many of these are early stage projects, however, and the mix of projects and their underlying capital estimates could change significantly.

Operating properties

Our current sources of production are McArthur River/Key Lake, Rabbit Lake, Smith Ranch-Highland, Crow Butte and Inkai.

We plan to maintain production at these operations, and to expand production where we can by developing new mining zones. We are upgrading the mills at Key Lake and Rabbit Lake to support our plans for production growth.

Inkai blocks 1 and 2, in Kazakhstan, have the potential to significantly increase production. Based on current mineral reserves, we expect Rabbit Lake to produce until 2017, although work is ongoing to extend its mine life even further.

Development project

Cigar Lake is our project in development. It is a superior, world-class deposit that we expect to generate 9 million pounds of uranium per year (our share) after we finish construction and ramp up to full production. We are targeting first commissioning in ore in mid-2013, with the first pounds to be packaged at the McClean Lake mill in the fourth quarter of 2013.

Projects under evaluation

We are evaluating several potential sources of production, including expanding McArthur River, increasing production at Inkai blocks 1 and 2, advancing Inkai block 3, increasing production in the US, and advancing Kintyre and Millennium.

- The McArthur River extension is expected to expand our existing mining area, which is part of the most prolific high-grade uranium system in the world.

- Under an MOU with our Inkai partner, National Atomic Company KazAtomProm Joint Stock Company (Kazatomprom), we are in discussions to increase annual production from blocks 1 and 2 to 10.4 million pounds (100% basis).

- Inkai block 3, in Kazakhstan, has the potential to become a significant source of production.

- We are the largest producer in the US and are planning to almost double annual production.

- Our 70% interest in Kintyre, in Australia, adds potential to diversify our production by geography and deposit type.

- Millennium is a uranium deposit in northern Saskatchewan that we expect will take advantage of our excess milling capacity.

We expect to spend between $20 million and $25 million per year on average for the next three years to assess the feasibility of projects under evaluation. These amounts will be expensed as incurred.

You can read more about each of these projects in Our operations and development projects.