Our Strategy

Positioned for success

Our strategy is set within the context of a challenging market environment, which we expect to give way to strong long-term fundamentals driven by increasing population and electricity demand.

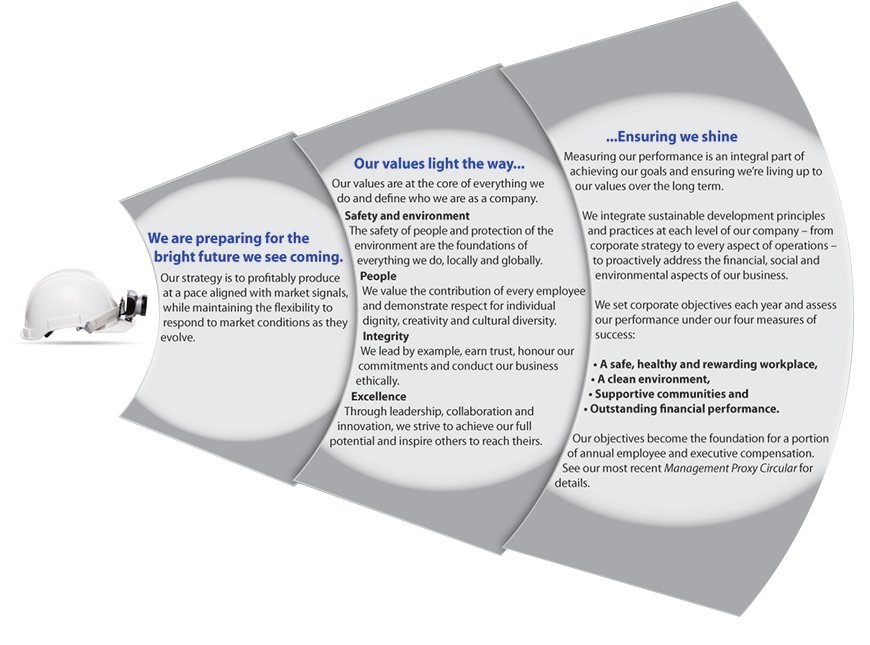

We are a pure-play nuclear fuel producer, focused on taking advantage of the long-term growth we see coming in our industry, while maintaining the ability to respond to market conditions as they evolve. Our strategy is to profitably produce at a pace aligned with market signals in order to increase long-term shareholder value, and to do that with a focus on safety, people and the environment.

Uranium

Our primary focus is on uranium production. It is the biggest value driver of the nuclear fuel cycle and our business. We have the ability to flex our production according to market conditions in order to return the best value possible. See Uranium – production overview for additional details.

Fuel services

Our fuel services division is a source of profit and supports our uranium segment while allowing us to vertically integrate across the fuel cycle. Our focus is on maintaining and optimizing profitability.

Enrichment

We continue to explore opportunities in the second largest value driver of the fuel cycle.

NUKEM

NUKEM’s activities provide a source of profit and give us insight into market dynamics.

Our mission is to energize

Our purpose is to bring the multiple benefits of nuclear energy to the world. We want to be the supplier, partner, investment and employer of choice in the nuclear industry.

Capital allocation – focus on value

Delivering returns to our long-term shareholders is a top priority. We continually evaluate our investment options to ensure we allocate our capital in a way that we believe will:

- create the greatest long-term value for our shareholders

- allow us to maintain our investment grade rating

- ensure we execute on our dividend policy

We start by determining how much cash we have to invest (investable capital), which is based on our expected cash flow from operations minus expenses we consider to be a higher priority, such as dividends and financing costs, and could include others. This investable capital can be reinvested in the company or returned to shareholders.

Reinvestment

Before investable capital is reinvested in sustaining, capacity replacement or growth, each investment must demonstrate it can meet the required risk-adjusted return criteria, and we must identify at the corporate level the expected impact on cash flow, earnings and the balance sheet. All project risks must be identified, including the risks of not investing. Allocation of capital only occurs once an investment has cleared these hurdles.

This may result in some opportunities being held back in favour of higher return investments, and should allow us to generate the best return on investment decisions when faced with multiple prospects, while also controlling our costs. If there are not enough good growth prospects internally or externally, this may also result in residual investable capital, which we would then consider returning directly to shareholders.

Return

If we determine the best use of cash is to return it to shareholders, we can do that through a share repurchase or dividend—either a one-time special dividend or a dividend growth policy. When deciding between these options, we consider a number of factors, including generation of excess cash, growth prospects for the company, growth prospects for the industry, and the nature of the excess cash.

Share buyback: If we were generating excess cash while there were little or no growth prospects for the company or the industry, then a share buyback might make sense. However, our current view is that the long-term fundamentals for Cameco and the industry remain strong.

Dividend: We view our dividend as a priority. Therefore, any change to our dividend policy must be carefully considered with a view to long-term sustainability. Currently, the conditions in the uranium market do not provide us with the level of certainty we require to implement changes to our dividend policy.

Marketing strategy – balanced contract portfolio

As with our corporate strategy and approach to capital allocation, the purpose of our marketing strategy is to deliver value. Our approach is to secure a solid base of earnings and cash flow by maintaining a balanced contract portfolio that optimizes our realized price.

Uranium is not traded in meaningful quantities on a commodity exchange. Utilities buy the majority of their uranium and fuel services products under long-term contracts with suppliers, and meet the rest of their needs on the spot market. We sell uranium and fuel services directly to nuclear utilities around the world as uranium concentrates, UO2, UF6, conversion services or fuel fabrication. We have an extensive portfolio of long-term sales contracts which reflects the long-term, trusting relationships we have with our customers.

In addition, we are active in the spot market, buying and selling uranium when it is beneficial for us. Our NUKEM business segment enhances our ability to participate, as they are one of the world’s leading traders of uranium and uranium-related products. We undertake activity in the spot market prudently, looking at the spot price and other business factors to decide whether it is appropriate to purchase or sell into the spot market. Not only is this activity a source of profit, it gives us insight into underlying market fundamentals.

Optimizing realized price

We try to maximize our realized price by signing contracts with terms between five and 10 years (on average) that include mechanisms to protect us when market prices decline and allow us to benefit when market prices go up.

Because we deliver large volumes of uranium every year, our net earnings and operating cash flows are affected by changes in the uranium price. Market prices are influenced by the fundamentals of supply and demand, geopolitical events, disruptions in planned supply and other market factors.

Long-term contracting

We target a ratio of 40% fixed pricing and 60% market-related pricing in our portfolio of long-term contracts. This is a balanced and flexible approach that allows us to adapt to market conditions and put a floor on our average realized price, reduce the volatility of our future earnings and cash flow, and deliver the best value to shareholders over the long term. The ratio is also consistent with the contracting strategy of our customers.

Over time, this strategy has allowed us to add increasingly favourable contracts to our portfolio that will enable us to participate in increases in market prices in the future.

Fixed price contracts: are typically based on the industry long-term price indicator at the time the contract is accepted and escalated over the term of the contract.

Market-related contracts: are different from fixed price contracts in that they may be based on either the spot price or the long-term price, and that price is as quoted at the time of delivery rather than at the time the contract is accepted. These contracts also often include floor prices and some include ceiling prices, both of which are also escalated over the term of the contract.

Fuel services contracts: the majority of our fuel services contracts are at a fixed price per kgU, escalated over the term of the contract, and reflect the market at the time the contract is accepted.

Contract portfolio status

Currently, we are heavily committed under long-term uranium contracts through 2018, so we are being selective when considering new commitments. We have commitments to sell approximately 200 million pounds of U3O8 with 43 customers worldwide in our uranium segment, and commitments to sell approximately 70 million kilograms as UF6 conversion with 36 customers worldwide in our fuel services segment.

Customers – U3O8:

- Five largest customers account for 50% of commitments

Customers – UF6 conversion:

- Five largest customers account for 56% of commitments

Managing our contract commitments

We deliver more uranium than we produce every year. To meet our delivery commitments, we use uranium obtained:

- from our existing production

- through purchases under long-term agreements and in the spot market

- from our existing inventory

We allow sales volume to vary year-to-year depending on:

- the level of sales commitments in our long-term contract portfolio (the annual average sales commitments over the next five years in our uranium segment is 27 million pounds, with commitment levels through 2018 higher than in 2019)

- our production volumes, including from the rampup of Cigar Lake and from planned increases at McArthur River/Key Lake

- purchases under existing and/or new arrangements

- discretionary use of inventories

- market opportunities

Focusing on cost efficiency

Production costs

In order to operate efficiently and cost-effectively, we manage operating costs and improve plant reliability by prudently investing in production infrastructure, new technology and business process improvements. Like all mining companies, our uranium segment is affected by the rising cost of inputs such as labour and fuel.

As we ramp up to full production at Cigar Lake, we expect the initial cash costs to be higher, which is expected to increase our average unit cost of sales.

Operating costs in our fuel services segment are mainly fixed. In 2014, labour accounted for about 54% of the total. The largest variable operating cost is for zirconium, followed by energy (natural gas and electricity), and anhydrous hydrogen fluoride.

Purchases and inventory costs

Our costs are also affected by the purchases of uranium and conversion services we make under long-term contracts and on the spot market.

Previously, our most significant long-term purchase contract was the Russian Highly Enriched Uranium commercial agreement, which ended in 2013. With that source of supply no longer available, and until Cigar Lake ramps up to full production, to meet our delivery commitments, we will make use of our inventories and we may purchase material where it is beneficial to do so. We expect our purchases will result in profitable sales; however, the cost of purchased material may be higher or lower than our other sources of supply, depending on market conditions.

To determine our cost of sales, we calculate the average of all our sources of supply, including opening inventory, production and purchases. Therefore, to the extent the cost of our purchases are higher than the cost of our other sources of supply, we would expect our unit cost of sales to increase.

Financial impact

The impact of these increased unit costs on our financial results is expected to be temporary. As greater certainty returns to the uranium market, based on our view that the market will transition from being supply-driven to being demand-driven, we expect uranium prices will rise to reflect the cost of bringing on new production to meet growing demand, which should have a positive impact on our average realized price.

In addition, as Cigar Lake reaches full production and the expansion at McArthur River/Key Lake is complete, our production will increase, which we expect will create more stability in the unit cost of sales for our uranium segment.

Sustainable development: A key part of our strategy

Social responsibility and environmental protection are top priorities for us, so much so that we have built them into our corporate objectives as measures of success: a safe, healthy and rewarding workplace, a clean environment, supportive communities, and outstanding financial performance. For us, sustainability isn’t an add-on for our company; it’s at the core of our company culture. It helps us:

- build trust, credibility and corporate reputation

- gain and enhance community support for our operations and plans

- attract and retain employees

- manage risk

- drive innovation and continual improvement to build competitive advantage

Because they are so important, we aim to integrate sustainable development principles and practices at each level of our organization, from our overall corporate strategy to every aspect of our day-to-day operations.

Safe, healthy, rewarding workplace

We are committed to living a strong safety culture, while looking to continually improve. As a result of this commitment, we have a long history of strong safety performance at our operations and across the organization.

2014 Highlights:

- our total annual recordable injury rate decreased by 19% in 2014

- continued low average dose of radiation to workers

- won John T Ryan National Safety award for McArthur River mine

- top employer awards

A clean environment

We are committed to being a leading environmental performer. We strive to be a leader not only by complying with legal requirements, but by keeping risks as low as reasonably achievable, including taking steps to prevent pollution.

We track our progress by monitoring our impacts on air, water and land near our operations, and by measuring the amount of energy we use and the amount of waste generated. We use this information to help identify opportunities to improve.

2014 Highlights:

- decrease in treated water discharged to surface water

- continued focus on maintaining excellent water discharge quality, with an effort to minimize increases to water withdrawal while increasing production at our facilities

Supportive communities

Gaining the trust and support of our communities, indigenous people, governments and regulators is necessary to sustain our business. We earn support and trust through excellent safety and environmental performance, by proactively engaging our stakeholders in an open and transparent way, and by making a difference in communities wherever we operate.

2014 Highlights:

- over $300 million in procurement from locally owned northern Saskatchewan companies

- 794 local employees from northern Saskatchewan

- no significant disputes related to land use or customary rights

- community engagement activities at 100% of our operations

Outstanding financial performance

Long-term financial stability and profitability are essential to our sustainability as a company. We firmly believe that sound governance is the foundation for strong corporate performance.

2014 Highlights:

- continue to achieve an average realized price that outperforms the market

- ranked 25th out of 232 Canadian companies by Globe and Mail in governance practices

Monitoring and measurement

We take integration and measurement seriously. We have been producing a Sustainable Development Report since 2005, using the Global Reporting Initiative’s Sustainability Framework (GRI). It is our report card to our stakeholders. It tells them how we’re performing against globally recognized key indicators that measure our social, environmental and economic impacts in the areas that matter most to them. It provides information about our goals, where we’ve met, exceeded or struggled with them, and how we plan to do better. And in 2014 we also conducted a limited assurance of the report, carried out by Ernst & Young.

Aside from our commitment to the GRI, we manage and report on our sustainability initiatives in a number of ways:

- all of our operating sites are ISO 14001 compliant, with the exception of the Cigar Lake mine, where we plan to seek compliance after we have achieved commercial production. Further, we have secured a corporate ISO 14001 registration and we are going to be taking steps to roll all of our sites under this registration;

- we have participated in the Carbon Disclosure Project since 2006

Achievements

We are a four-time Gold award winner through the Progressive Aboriginal Relations program given out by the Canadian Council for Aboriginal Business. Also, in 2014, we secured approval to increase production at the McArthur River and Key Lake operation as a result of earning the confidence of our regulators, which includes their regard for the positive relationships we have with neighbouring communities in northern Saskatchewan. We are a leading employer of Indigenous peoples in Canada, and have procured over $3 billion in services from local suppliers in the region since 2004. And, we are proud to have been named one of Canada’s Best Diversity Employers, Top 100 Employers, and Saskatchewan’s Top Employers for five consecutive years.

We encourage you to review our SD report at cameco.com/about/sustainability which outlines our commitment to people and the environment in more detail.